News

Bridging Loans Explained: A Summarised FAQ

What are bridging loans?

As the name suggests, a bridging loan is a temporary solution for a short-term financial gap. Typically, issued over the course of no more than a few months, bridging finance effectively ‘bridges’ the gap between a purchase or investment and the procurement of funds by other means.

What can bridging loans be used for?

One of the most appealing aspects of bridging finance is the way in which it can be used for almost any legal purpose whatsoever. Even so, some of the most popular applications for bridging finance in the UK are as follows:

- Opting out of property chains or reversing chain break scenarios

- Purchasing properties at auction for less than their true value

- Beating competing bidders to the punch by purchasing properties for cash

- Buying ‘unable to mortgage’ properties to renovate and sell on

- Covering unexpected business costs and general outgoings

- Buying homes to be renovated and let out to tenants

- Just as long as you can provide your lender with proof of a viable exit strategy (how you plan to repay the loan), there are no limitations placed on how you can use the funds.

Bridging loans are not restricted solely to property use, but, as we’re writing a property blog, that’s what we’ll stick to here today.

How is interest calculated on a bridging loan?

Interest and overall borrowing costs on bridging finance vary from one facility to the next. Instead of a conventional APR, bridging loan interest rates are usually published as a monthly rate of interest (which can be as low as 0.5%).

This interest can be repaid monthly or rolled up into the final loan balance. Likewise, all associated borrowing costs (arrangement fees, transaction fees, completion fees, etc.) can be added to the final balance payable.

In the meantime, no monthly repayments are necessary, enabling the borrower to maintain total cash flow efficiency. The full balance is then repaid in a single lump-sum payment on an agreed-upon date.

What is the difference between open and closed bridging loans?

Open-bridging loans are those that are issued with no fixed repayment date. The borrower enjoys a greater degree of flexibility with regard to when the loan is repaid, but open bridging loans are riskier for the lender and therefore have higher overall borrowing costs.

With a closed bridging loan, the borrower agrees to repay the loan on or before a specific date. Such loans are considered lower-risk for the lender and are therefore usually more competitive in nature.

What’s the difference between first charge and second charge loans?

A first-charge loan is primarily taken out against an asset of value, such as a home or business property. For example, when you buy a home with a conventional mortgage, this is a first-charge loan: the first and only debt secured against your home.

If you then take out a bridging loan against the equity you have built up in your home (but while you are still repaying your mortgage), it will be issued as a second-charge loan. This is because there is already a primary debt (first charge loan) secured against your home, which, in the event your home is repossessed to repay your debts, will take priority.

Second-charge loans can be more difficult to secure than first-charge loans, and due to their higher risk, they can also be more costly than first-charge loans.

Who can qualify for bridging finance?

Bridging finance eligibility centres on the availability of assets of value to secure the loan and evidence of a viable exit strategy. Where both of these requirements are met, the applicant will most likely qualify, irrespective of their credit history and employment status.

Even so, the key to qualifying for a competitive bridging loan lies in comparing the market with the input and support of a specialist broker. This is particularly true where ‘ subprime’ bridging loan applications are concerned, but it also applies to mainstream bridging finance applications in general.

Downsizing: Bridging the Gap

Downsizing to a smaller home should be a simpler task than moving into a larger home or buying your first property. Your current home may have a much higher market value than that of your target home, putting you in a great position to relocate and have plenty of extra money left over.

Or at least, this is how the whole thing should work on paper. In practice, it rarely works out quite so straightforwardly.

Having built up plenty of equity in a home is all well and good, but converting this equity to cash to buy a new home is not always easy. Prior to purchasing your next home, you first need to find a buyer for your current home. A process that means not only finding an eligible buyer but waiting for their mortgage application to be processed (assuming it is successful at all).

In the meantime, the risk remains of being beaten by a competing bidder. If another interested party is able to buy your target home faster than you, chances are that is exactly what they will do. Likewise, if you have lined up a buyer for your current home who backs out at the last minute, you are back to square one.

Breaking the chain

This risk of a broken property chain does not apply exclusively to more standard moves or when upgrading to a larger home. Even if you plan to move to a home that is significantly smaller and lower in value, you still face the prospect of being beaten to the finish line.

In fact, the growing demand for smaller homes that are affordable to run has resulted in a situation where competition for these types of homes is growing at a much faster rate than competition for larger homes. The more people there are bidding for the select properties available, the higher the chance of a broken property chain.

But there is a way to almost entirely eliminate the risk of a property chain crashing down at the worst possible time. Increasingly, homeowners are setting their sights on short-term bridging finance to ensure they are at the front of the queue. With bridging finance, it is possible to tap into most (up to 80%) of the equity you have in your home in a matter of days.

A flexible and affordable solution

Bridging finance is issued in the form of a short-term loan (usually over a term of no more than 12 months), secured against the home of the applicant. With all the essential paperwork in place, the funds can often be accessed within a few working days.

This money can then be used to purchase a smaller home for cash while their previous home remains on the market. When their former home sells for its full market price, the loan is repaid in full, and the remaining proceeds are retained. Charged at around 0.5% per month or less, overall borrowing costs on a bridging loan can be extremely low.

As cash buyers are often afforded significant discounts on property prices for fast transaction completions, the savings made could augment the costs of the facility in its entirety.

Best of all, bridging finance eligibility requirements are far more relaxed than most comparable products. You simply need sufficient equity in your current home to cover the costs of the loan and evidence that you will be able to repay the loan by the agreed-upon date (exit strategy).

Once a financial product used nearly exclusively by property developers and investors, competition in the housing market has propelled bridging finance into the mainstream lending sector.

Bridging Loan for Fast Home Purchases

Having found your perfect home at a price you can afford, you suddenly find yourself in a major race against time. Given the attractiveness of the property and its price, it’s highly unlikely you are the only interested buyer.

This is where the limitations and imperfections of conventional mortgage loans become painfully apparent. You can comfortably afford the repayments on the mortgage you need, and your deposit is good to go, but you are still at the mercy of your bank’s standard underwriting and processing times.

All of this means you could be waiting as long as 12 weeks to get your hands on the money you need, during which there is a high likelihood of being beaten to the punch.

A Faster and Simpler Alternative

Ferocious competition on the housing market has spurred a major spike in bridging finance enquiries and applications over the past two years. Bridging finance differs from a conventional mortgage in that it is a strictly short-term facility.

With a bridging loan, you are able to raise money against the equity you have in your current home and use it to buy your next home outright. Importantly, a typical bridging loan can take as little as a few working days to arrange, giving you every chance of being at the very front of the queue.

You purchase your next home for cash, and you repay your bridging loan in full when your previous home sells. In the meantime, interest is added at a rate as low as 0.5% per month, making bridging finance usually cost-effective when repaid promptly.

If you are completely confident your home will sell in the near future without any issues, a bridging loan could prove so much more affordable than a conventional mortgage.

What is the Difference Between an Open and Closed Bridging Loan?

If you decide to apply for a bridging loan to purchase a property fast, you will come across two different loan options, open and closed bridging loans:

Open Bridging Loans. This is a bridging loan that is issued without a fixed repayment date. Your lender will expect to be repaid within a certain period of time, but no specific repayment date is agreed upon during the application process. As a higher-risk loan on the part of the lender, open bridging tends to be slightly more expensive.

Closed Bridging Loans. With a closed bridging loan, you commit yourself to an exact repayment date, by which the full balance of the loan will be repaid. There may also be the option of repaying earlier to save money, with no additional fees or charges incurred.

Which of the two is suitable for you will be determined by how quickly you believe your home will sell after taking out your bridging loan. If demand is high and your home will sell within no more than a few months, a closed bridging loan could be ideal. If you cannot say for sure when your home will sell, an open bridging loan may be more appropriate.

Will I Qualify for a Bridging Loan?

Eligibility for bridging finance is determined on the basis of two main factors which are security and your repayment plan (exit strategy).

Bridging loans are secured against assets of value, which in this case means the equity you have tied up in your current home. Loans are issued with a maximum LTV of 80%, which means that if you have £400,000 of equity in your current home, you could borrow £320,000.

When buying and selling homes the exit strategy for your bridging loan will be the sale of your current home, if your lender is confident that demand is high enough to guarantee the sale of your home in the near future (and for a good price), they will almost certainly approve your application.

Even with poor credit and/or no formal proof of income, it is still possible to qualify for affordable bridging finance.

Cash Buyers Catching the Eye of Home Sellers

Exactly what the next few years have in store for house prices remains to be seen. But what seems like a foregone conclusion in the eyes of most market watchers is a fairly significant fall in average house prices.

Savills recently predicted a 10% drop in 2023, while Knight Frank has forecast a 10% fall over the next two years. Elsewhere, Credit Suisse and Capital Economics have both projected a fall of between 10% and 15% within the next 12 months.

The consensus, therefore, appears to point to a fairly turbulent year to come for home sellers, at least for those looking to get the best possible prices for their properties. Average house prices are unlikely to get any higher than they are right now, seemingly making now the time to sell before any further declines creep into the mix.

Not only is this exactly what many are doing, but it is becoming commonplace for home sellers to set their sights primarily (if not exclusively) on cash buyers.

Chain-free sales

To hang around and wait for a potential 10% drop in property prices could prove catastrophic for anyone pursuing maximum capital gains. As a result, more home sellers than ever before are demonstrating enthusiasm (if not desperation) where selling their properties quickly is concerned.

A growing contingency of UK sellers is accepting inquiries and offers only from chain-free buyers, who can purchase their homes outright for cash.

The results of a recent survey conducted by mortgage broker MPowered found that as many as two-thirds of UK home sellers are only interested in offers from chain-free buyers. In addition, almost 30% said that they would charge higher prices for their homes if they sold them to standard mortgage-reliant buyers.

What this adds up to is a property market where those who are able to purchase homes outright for cash have a major advantage over competing bidders. Not just in terms of beating them to the punch, but also in their access to exclusive deals and discounts on property prices.

Traditionally, it has been practically impossible for everyday homebuyers to access the benefits afforded exclusively to cash buyers, but as the market for bridging finance continues its expansion, more mainstream buyers than ever before are empowering themselves with cash-buyer capabilities.

Bridging finance for fast property purchases

Escaping property chains and funding fast home purchases has become the number-one use for bridging loans in the UK. With bridging finance, the funds needed to purchase a property for cash can be raised within a few working days. Bridging loans are short-term products issued over terms of 12 months or less and secured against assets of value (typically residential or commercial property).

As mortgage rates continue to head ever-skyward, average bridging loan rates remain close to historic lows. Current deals are averaging just under 0.5% per month, equating to an APR of around 5.6%. But as the vast majority of bridging loans are repaid within a few months, bridging finance can work out exponentially more cost-effectively than any comparable mortgage.

Bridging finance is therefore providing home buyers from all backgrounds with a welcome lifeline—one that enables them to compete with the market’s more established cash buyers. Rather than being denied access to a sizeable chunk of the property market (and paying over the odds), anyone who can qualify for bridging finance can access all the benefits of purchasing homes for cash.

For more information on any of the above or to discuss the potential benefits of bridging finance in more detail, call anytime for an obligation-free consultation.

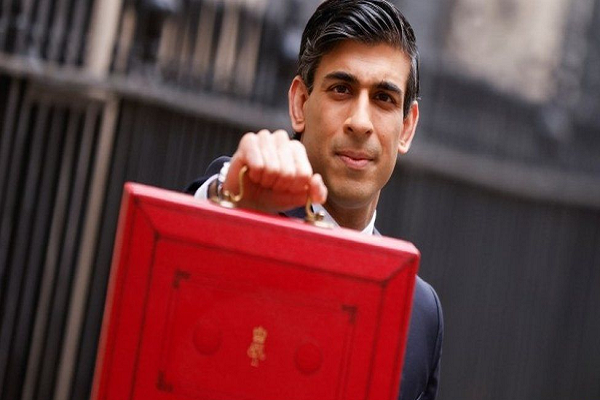

How the Budget is Likely to Affect the Housing Market

Things have been moving so fast as of late that it is difficult to believe it was only eight weeks ago that Kwasi Kwarteng devastated the UK economy with his catastrophic mini-budget. Since then, Jeremy Hunt has introduced a broad range of spending cuts and tax hikes with the aim of reversing at least some damage done by his predecessor and championing ‘stability, growth, and public services’.

According to the latest forecasts from the Office for Budget Responsibility, the UK is well and truly in recession, and inflation will likely level out at 9.1% at the end of this year.

As one of several measures brought into the housing market, the chancellor announced that the cuts to stamp duty, which Kwarteng announced would be permanent, would be phased out by March 2025. This basically means that a two-year time limit has been put on the cuts, after which they will be withdrawn.

Kwarteng had doubled the threshold at which stamp duty is paid to £250,000, while first-time buyers are also exempt from paying the first £425,000 of their purchase as long as the overall property price is below £625,000, rather than the previous £300,000.

Mr Hunt said that such an incentive will help support the housing market at a time when the economy needs it most, after which the gradual projected slowdown for the housing market over the next couple of years will render it less vital.

Figures from the OBR suggest that house prices could fall by as much as 9% between now and the third quarter of 2024, prompted largely by higher mortgage rates and a general lack of ability. The less competition there is for today’s excessively priced homes, the lower their prices will fall over time.

While a potential fall in average property prices of 9% seems steep, it is less so when put into perspective. Between the 12 months leading up to October this year, average property prices in the UK increased by a further 8.3%, according to data from Halifax.

Promising ‘to restore public finances and make the tax system fairer’, Mr Hunt also outlined a reduction in the previous tax-free allowance for capital gains tax (CGT), down from £12,3000 to £6,000 in 2023/24 and again to £3,000 in 2024/25. This is likely to have a significant impact on the general finances of second homeowners and landlords, who will be liable for larger payments upon selling residential properties.

But as the 28% CGT tax rate for higher-rate taxpayers has not been hiked, the outcome is not quite as bad as many had expected.

Elsewhere, the 45p rate tax threshold was reduced from £150,000 to £125,000, instantly moving a great many earners across the UK into the higher tax bracket. The chancellor declared that the inheritance tax nil-rate band would be frozen until the 2027–2028 fiscal year and that owners of electric vehicles would no longer be exempt from paying road taxes starting in 2025–2026.

What this means for the housing market

The combination of higher interest rates, higher taxes, and an elevated cost of living will undoubtedly have a knock-on effect on the housing market. People across the UK are already shelving their property purchases and investment plans indefinitely, and the trend is likely to continue for some time.

During this, a significant fall in average house prices is expected, but not so much as to reverse the extraordinary gains UK homes have collected over the past few years. Mortgage availability will likely increase as stability returns to the market, but most experts think the general picture will get worse before it gets better.

Council Home Construction in London Outpaces the Rest of the Country Combined

Newly published government data suggests that more council home construction projects commenced in London in 2021 than in the rest of the country combined. A total of 5,494 projects broke ground in the capital last year, compared to 4,325 spanning the rest of England as a whole.

Combined, this adds up to the most new council housing projects commenced in any year since 1979, when 9,128 projects broke ground.

Southwark was the London Borough that topped the table in terms of new council housing starts, with 895 new projects having commenced last year.

“There’s no quick fix to London’s housing crisis, but we’re taking significant steps in the right direction by backing a new renaissance in council homebuilding,” commented Mayor of London Sadiq Khan.

“In London today, we’re not just building more council homes; we’re building better homes too. The new generation of council homes are some of the best that have ever been built: modern, sustainable, and fit for the 21st century.”

“These new homes form a key part of building a better London for everyone: one that is greener, fairer, and more prosperous for all.”

“But the headwinds from recent economic chaos, combined with the effects of the pandemic, Brexit, the soaring cost of construction materials, and rising inflation, are hitting housebuilders hard and making housing delivery increasingly challenging.”

“That’s why I am urging ministers to provide additional funding so I can continue to deliver the good-quality and genuinely affordable homes that Londoners desperately need.”

The leader of Southwark Council, Kieron Williams, also praised the efforts being made to provide more affordable housing options in London.

“With the cost of living soaring, now more than ever, we need more council homes in our city,” he said.

“I’m delighted that we were able to start another 895 in Southwark last year, thanks to support from the Mayor, alongside our own council investment.”

“Achieving the most starts in London has been far from easy given the tidal wave of challenges facing the construction industry.”

“What worries me now is that those challenges are only getting harder as the national housing crisis deepens and construction costs spiral.”

“Having such a strong partnership between the mayor and councils is making a real difference, but we urgently need the government to get serious about solving the housing crisis too.”

Living cost crisis

The construction of thousands of new council homes in London may eventually bring some relief to those who continue to find themselves priced out of the market. In the meantime, the growing exodus of younger renters leaving London to find more affordable homes elsewhere is likely to continue.

Between April and March this year, the average rental price for a one-bedroom property in London equalled just over 46% of the average Londoner’s gross median pay. By contrast, renters across the rest of the country use around 26.4% of their gross median pay for rent.

According to Foxtons Estate Agents, one of the main drivers behind skyrocketing rent prices in London is explosive demand, coupled with minimal available inventory. They said that around 23,000 rental properties were listed on the market in September, meaning that an average of 29 people were competing for each property listed.

There are approximately 9% fewer properties available on the private rental market in London than at the same time last year, while demand has increased by as much as 20%.

Consequently, as many as 20% of younger people are planning on leaving London entirely, as they simply cannot afford to keep spending so much of their money on rent costs alone.

Return to normality triggers further affordability issues

Speaking on behalf of Hamptons, head of research Aneisha Beveridge said that the return to the new normal would most likely continue pushing average London rental prices higher.

“With COVID-19 being pushed further to the back of people’s minds, life in the capital is slowly returning to its new normal. Tenants are returning to the bright lights of the city, and this is driving rental growth to record highs,” she said.

“The rise of remote working means that fewer tenants are moving to the capital specifically for work. In fact, a growing number of tenants choosing to live in London are working fully remotely and could live nearly anywhere in the country. The footloose nature of many jobs today means that it will be culture and lifestyle rather than employment that become the capital’s biggest draw.”

Second Charge Borrowing Hits New High in November

Despite the lingering economic uncertainty that has maintained a tight grip on the UK throughout 2022, second-charge lending has once again seen a bumper year. A minor slowdown in lending volumes was recorded over the past two months, but the overall picture for the year was one of record combined loan values.

According to the latest Secured Loan Index published by Loans Warehouse, total year-on-year second charge lending for 2022 was up by almost 37% in November, coming out at a total of £1.6 billion in loans issued. This marked the sector’s best performance since 2007, even with the figures having been released with two months still to go until the end of the year.

The figures from Loans Warehouse indicated a significant decline in the number of high LTV loans being issued in November, with 85% or higher LTV products accounting for just 13.7% of loans issued. In addition, average loan terms have increased by approximately one year, suggesting that more borrowers are looking to spread the costs of their purchases and projects over a longer period of time to compensate for the escalating living costs crisis.

“The average term of a secured loan has increased by 12 months, potentially linked to lenders’ affordability being stretched more than ever before in recent times,” commented Matt Tristram, managing director of Loans Warehouse.

“Finally, many lenders have significantly improved their completion time, likely a result of a dip in the record-breaking lending levels seen across the summer months.”

What is second-charge borrowing, and how is it used?

Second-charge borrowing refers to a type of loan that is secured against a property that has already been used as collateral for another loan. The term “second charge” refers to the fact that the loan is considered a secondary priority if the borrower defaults on their payments and the lender needs to sell the property to recover their money.

This subsequently means that the original first charge loan on the property (such as a mortgage) would be repaid first in the event of repossession, followed by the second charge loan.

There are countless different uses for second-charge borrowing, which can technically be used for almost any legal purpose. Some of the most popular applications for second-charge products in the UK are as follows:

- Home improvements: One of the most common reasons for taking out a second-charge loan is to fund home improvements. This can include things like renovating a kitchen or bathroom, adding an extension, or updating heating and electrical systems.

- Debt consolidation: Second-charge borrowing can also be used to consolidate multiple debts into one single loan with a lower interest rate. This can be particularly useful for individuals who have multiple credit card debts or other high-interest loans.

- Business use: Some borrowers use second-charge loans to fund business ventures or expansion projects. This can include things like buying new equipment or hiring additional staff.

- Funding education: Second-charge loans can also be used to pay for education-related expenses, such as tuition fees or the cost of relocating to a university.

- Unexpected outgoings: In some cases, individuals may take out a second charge loan to cover unexpected expenses, such as medical bills or car repairs.

It is important to note that while it can be an affordable facility, second-charge borrowing is not suitable for everyone. Lenders typically require borrowers to have a good credit score and sufficient equity in their property to qualify for second-charge loans. Additionally, second-charge loans are generally more expensive than first-charge loans, as the lender is taking on more risk by providing the loan.

However, some secured loan specialists are willing to issue second-charge loans to applicants who do not fulfil the ‘mainstream’ criteria set out by banks in general. For example, you may still be able to qualify for a competitive second-charge loan with poor credit, but you will need to target a specialist lender with your application.

Small Housebuilders Blighted by Inaccessible Mortgages

Smaller housebuilders in the UK appear to be hindered from building new houses by problems related to mortgage accessibility, according to research performed by the Federation of Master Builders (FMB). After conducting a poll on 122 SMEs within the house building sector, the FMB found that 38% were finding mortgage accessibility issues a barrier to their planned projects.

Worse still, almost 50% said they expect the problem to worsen over the coming years.

62% of those polled said that lack of ‘available and viable’ land is the single biggest obstacle in the way of residential housing projects. 60% said the current planning system remains a major issue, while close to 50% said that the delivery of new projects is being hampered by a lack of skilled workers.

The government is being lobbied to alter its immigration policy to allow skilled workers into the UK to support the housebuilding sector, having once again failed to come anywhere near meeting its own long-promised annual housebuilding targets.

“This year’s FMB House Builders’ Survey highlights the persistent barriers holding back small, local house builders,” said Brian Berry, chief executive at the FMB.

“Delays in the planning system and a lack of available and viable land are stopping the industry from building the homes that are needed.”

“The lack of mortgage availability reveals the damage that the current economic turbulence has created.”

“A lack of skilled labour is another major barrier holding back the potential of SME house builders. This will come as a little surprise to many.”

“The government must look to develop homegrown talent, but targeted immigration has to be an option on the table to support the industry.”

“The government can achieve its ambitions for growth and levelling up by supporting the nation’s SME house builders.”

“Who better to invest in than local house builders, who act as the engines of growth in their communities, employing local workers, training local school teachers, and delivering quality homes?”

Rishi Sunak faces rebellion over housing policy

Meanwhile, Rishi Sunak is staring down the barrel of a major Tory MP rebellion, with more than 50 MPs calling for an amendment that would end housebuilding targets for local councils.

Led by the former cabinet minister Theresa Villiers, the amendment so far has the backing of 46 MPs, who want to see housebuilding targets made advisory rather than mandatory. The proposal has been met with disappointment and disdain from the opposition, with campaigners stating that it will cause further harm to the UK’s already struggling housing sector.

Damian Green, Esther McVey, Priti Patel, Chris Grayling, and Iain Duncan Smith are among the prominent names that have given their backing to the proposed amendment.

But rather than supporting the housing sector, critics are adamant that the amendment would further reduce the availability of affordable housing inventory across the UK.

“The actual effect would be to enshrine nimbyism as the governing principle of British society, to snap the levers that force councils to build, and to leave every proposed development at the mercy of the propertied and privileged,” commented Robert Colville, director of the CPS thinktank.

Meanwhile, former levelling-up secretary Simon Clarke expressed his own surprise and disdain for the amendment.

“There is no question that this amendment would be very wrong. I understand totally how inappropriate development has poisoned the debate on new homes in constituencies like Chipping Barnet [Villiers’ constituency], but I do not believe the abandonment of all housing targets is the right response,” he said.

“We also need to recognise the fundamental inter-generational unfairness we will be worsening and perpetuating if we wreck what are already too low levels of housebuilding in this country. Economically and socially, it would be disastrous. Politically, it would be insane.”

The shadow housing secretary, who characterised the entire situation as a move in the wrong direction, expressed similar sentiments.

“This is a complete shambles. The government cannot govern, the levelling-up agenda is collapsing, and the housing market is broken. Pulling flagship legislation because you’re running scared of your own backbenchers is no way to govern,” she said.

“There is a case for reviewing how housing targets are calculated and how they can be challenged when disputed, but it is completely irresponsible to propose scrapping them without a viable alternative in the middle of a housing crisis.”

“Labour will step up to keep this legislation moving. There is too much at stake for communities that have already been victims of Tory chaos and of a prime minister too weak to stand up to his own party.”