News

Average House Prices in Scotland Hit a New All-Time Record High

First-time buyers looking to get on the Scottish property ladder could be facing an uphill struggle this year as average property prices reach new record highs. For the seventh time within the past 12 months, the average market value of a home in Scotland has broken all previous records.

New data from the Walker Fraser Steele House Price Index indicates that the average price of a home in Scotland hit £218,702 in February 2022, an increase of £16,600 compared to February 2021.

On a monthly basis, Scottish house prices were up 1.5% in February compared to the month before, amounting to a one-month increase of £3,200 on average. This is the largest monthly increase recorded since August last year, with average house prices increasing in 30 of Scotland’s 32 local authority areas over the past year.

Only two areas recorded slight reductions in price over the past 12 months, which were Clackmannanshire and Aberdeen City. Meanwhile, the Orkney Islands saw the biggest gains of all, where average house prices increased by a huge 28.6% since the same time last year.

Competition remains ferocious

Senior housing analyst at Fraser Steel, John Tindale, highlighted similarities in the real estate sectors of England and Wales. Last month, all nine English and Welsh regions recorded all-time high average property prices, with Wales achieving the strongest annual growth rate of 8.9%.

“There is still high demand for such homes, but supply is limited, so there continues to be strong competition for the properties that do come on the market, with resultant price increases.”

Elsewhere, the regional development director at Walker Fraser Steele, Scott Jack, said that the way Scotland’s real estate sector has returned to strength was highly impressive.

“As a piece of context, in February this year, all the regions in England and Wales established new record average house price levels, but it is fair to say that the Scottish property market has robustly withstood one of the most seismic events in living memory in the past couple of years,” he said.

Shifting priorities and changing lifestyles

Analysts continue to cite the ongoing home-working trend as the biggest single contributor to explosive competition in the UK’s housing market.

Meanwhile, record-high rent yields across the country are motivating landlords and investors to expand their portfolios, putting even greater strain on the sector’s limited available inventory.

Even as the gradual return to the office accelerates, lifestyle changes brought about by the pandemic are likely to continue altering the public’s priorities in the long term. All of which is likely to sustain the housing market’s blistering performance indefinitely as demand continues to outpace supply by a clear margin.

Landlords and Homeowners to Get Tax Relief to Improve Energy Efficiency

Following the Spring Statement this month by the Chancellor of the Exchequer, Rishi Sunak, landlords and homeowners were given the good news that all materials used for improving energy efficiency in their properties would now be VAT-free for the next 5 years, down from the previous figure of 5%.

This reduction in tax represents an estimated saving of £1,000 upfront and will further result in lower energy bills, saving around £300 per year per household. The announcement comes at a perfect time, particularly for landlords who are required to meet new EPC regulations to upgrade their properties and make them more environmentally friendly.

The new EPC (Energy Performance Certificate) regulations stipulate that landlords must increase the rating of their properties to the minimum of a C rating by 2025. This applies to all new tenancies and will be followed by all tenancies by 2028. This could add up to a large bill for landlords, who will be required to make any changes needed to reach the required rate, so the zero VAT on materials will help to keep costs down.

The 5% saving on materials will give landlords an opportunity to reduce their outgoings during periods when their properties are vacant and will in turn help tenants by reducing their energy costs, which will be gratefully received considering the recent increases in rental prices.

Rental rates have increased at their highest annual rate for more than five years, hitting the highest growth seen within the last year. The ONS (Office of National Statistics) has released data showing a 2.3% increase in prices in the private rental sector, the highest seen since December 2016.

The largest rental growth was recorded in the East Midlands, with an increase of 3.8%. London showed the lowest rental price hike, increasing only 0.2%, primarily due to the change in working habits, with many people opting to continue to work from home post-pandemic, according to the ONS. Excluding London, the rest of the UK saw rental prices increase by 3.2% in the last 12 months, up slightly from 3% in the year to January 2022. Looking at each individual country, Scotland leads the way with a rise of 2.6%, followed by England at 2.1% and Wales at 1.4%.

Research conducted by Rentd revealed that the average earnings of tenants fell far below the affordability level for rental prices across all regions of all five nations. This is calculated by looking at the average earnings of a typical renter and using a benchmark of two and a half times the average rental rates. The report found that the average annual wage for those who rent in the private sector was 12% lower than the wider average, with an average income of £28,116.

Across the UK, the average rental price is £968 per calendar month (£11,616 per annum). A tenant would need to have a salary of at least £29,041 to comfortably be able to afford this rental rate. This is a shortfall of £925 when calculating using the 2.5 times wage affordability formula.

With inflation spiralling and the cost of living rapidly increasing, many renters’ dreams of homeownership are becoming unreachable, putting even more pressure on the private rental sector to find more housing stock. The demand for quality, affordable rental properties is on the increase, with both landlords and tenants needing support through these turbulent times.

Reducing Borrowing Costs with New Equity Release Rule

Homeowners, who have taken advantage of equity release finance, are now able to make additional partial payments without any charges or penalties in a bid to reduce borrowing costs.

Although this is a feature already offered with some later-life lending products, as of March 28th, the Equity Release Council announced that it will be mandatory for lenders to include this feature with all equity release finance products.

The ability to make extra payments will result in homeowners reducing the impact of compound interest later down the line and decreasing the overall cost of equity release.

Equity Release Finance is a way of releasing the tied-up cash in your home. It allows for borrowing against the equity in your house without being required to make any repayments. The loan is repaid when the borrower either moves into residential care or passes away. To be eligible for equity release, you must be over 55 years old.

This new rule will allow the homeowner to make payments as and when they wish, thereby reducing the amount that the lender will be repaid when the time comes.

The Equity Release Council, which announced the news regarding the new product safeguard on Monday, stated that over the next decade, a total of £39 million in combined savings can be achieved, with further figures predicted to be a whopping £99 million in expected savings over the next twenty years.

Data shows that, in 2021, more than 125K part payments towards equity release plans were made without penalty.

Jim Boyd, CEO of the Equity Release Council, said: “The right to remain in your home for life, with no requirement to make ongoing repayments and no threat of repossession, has been central to the appeal of equity release since 1991 and remains a core pillar of the modern market.

“Our new product standard adds to this by ensuring people have the freedom to reduce their borrowing if circumstances change.

“It enables equity release customers to mitigate the effects of compound interest and reduce their borrowing costs in later life, which we know is often one of their main concerns.”

This latest product standard, released and enforced by the Equity Release Council, sets out the following parameters:

It gives the homeowner the right to live on the property for the rest of their lives; they will also have no obligation to make any payments until they go into full-time care or pass away.

The interest rate is capped or fixed for life. The rate of interest will never change, even when base rates change.

No negative equity guarantee: The debt will never be more than the home is valued at, meaning that relatives will not be burdened with any funds owed to the lender.

The right to move the loan: Providing it meets the criteria, the loan can be moved to a different property.

Jim Boyd added: “Equity release today is a flexible financial planning tool for a range of scenarios, from gifting to family to supporting better living standards over longer lives in retirement.

“Consumers should always use a Council member to explore their options and alternatives to equity release, to benefit from product protections and expert advice, and to decide if it is right for them.”

Bridging Loans for Property Development: How Does it Work?

Specialist development finance is a popular choice for property developers and construction companies, providing prompt access to significant sums of money for extensive and ambitious projects.

However, there are scenarios where a bridging loan for property development could be a better choice. Unlike development finance, bridging loans are issued in the form of a single lump sum. Not released in a series of stages as the project progresses. In addition, qualifying for a bridging loan can be fairly straightforward, whereas development finance is offered exclusively to established property developers.

But how does a development bridging loan work, and what are its key features? More specifically, what makes a bridging loan for property development a better choice than a standard commercial loan or mortgage?

Typical applications for property development bridging loans

A bridging loan can be used for any legal purpose, with few restrictions as to the potential applications for the funds. Some of the more common uses of property development bridging loans are as follows:

- To pick up low-cost properties at auction and to fund the subsequent renovations required.

- To purchase a plot of land quickly and beat rival bidders to the punch.

- To commence and complete a project as quickly as possible when time is a factor

- To fund any kind of property development project as a new or experienced developer.

Property development bridging loans can also be a useful facility for subprime applicants who would otherwise be unable to qualify for a conventional property loan or mortgage.

How does a development bridging loan work?

A development bridging loan is a strictly short-term facility designed to ‘bridge’ a temporary financial gap. Ideal for time-critical purchase and investment opportunities, a bridging loan can be arranged and issued within the space of a few days.

Repayment typically takes place six to 18 months later, in the form of a single lump-sum payment inclusive of rolled-up interest. Monthly interest applies at rates as low as 0.5%, negotiable in accordance with the size and nature of the loan taken out.

Maximum loan values are tied to the assessed value of the assets used to secure the loan, which is typically the home or business property of the applicant. Lending policies vary, but most bridging finance specialists are willing to offer anything from £50,000 to more than £10 million.

How much deposit do I need for a development bridging loan?

Technically speaking, there is no specific deposit requirement for a development bridging loan. Most lenders are willing to offer loans with a maximum LTV of 70% to 80%. This would therefore mean that the investor would need to cover the other 30%/20% of the costs, but not in the form of a deposit in the conventional sense.

A higher loan-to-value ratio can sometimes be negotiated, often up to 100% LTV. An alternative option is to take out a bridging loan with an LTV of 70% or 80% and use a second- or third-charge loan from a separate provider to cover the additional costs.

As all development bridging loans are bespoke agreements between the issuer and the borrower, terms and conditions can be negotiated to suit all requirements and preferences.

Getting the best deal on a development bridging loan

All bridging loan applications are assessed on their individual merit, highlighting the importance of presenting a convincing case.

Specifically, there are four factors that will determine the competitiveness or otherwise of the loan you are offered:

- Your exit strategy: Your lender will expect to see evidence of a viable exit strategy, i.e., when and how you intend to repay the loan. For example, by selling the property you plan to purchase after renovating it, you raise the capital needed to repay the loan, resulting in additional profits for you to retain.

- Available assets: All property development bridging loans are secured against viable assets – usually residential or commercial property. However, some lenders are willing to accept other assets of value, ranging from vehicles to business equipment to intellectual property to company shares.

- Credit history: Poor credit will not necessarily count you out of the running for a competitive bridging loan. Most lenders are willing to work with subprime applicants, but a good credit history could help you qualify for the best possible deal.

- Experience: Understandably, lenders will usually reserve their best deals for applicants with an established track record in the property development sector. The more experienced you are, the more likely you are to qualify for a competitive bridging loan.

With each of the above, your broker will provide the independent support and advice you need to present a convincing case to your preferred lender.

Your broker will also negotiate on your behalf to ensure overall borrowing costs are kept to the bare minimum.

Price of Mortgages Predicted to Be £800 More Per Annum Than in October 2021

According to mortgage advisor L&C, people looking to remortgage their homes are expected to pay, on average, an additional £800 each year when compared to just five months ago.

The analysis was based on several parameters, using the example of a homeowner who had 40% equity in their property and was looking to take on a 2-year fixed-rate mortgage over a 25-year period on a mortgage of £150,000.

Figures provided by the Bank of England showed that applications for remortgage products rose in the last quarter of 2021 in proportion to overall lending. Market experts indicated that homeowners remortgaging the properties were hoping to grab a good deal before interest rates rose further, as they are predicted to do in the coming months.

Interest rates from major lenders were used by L&C, which were averaged out to create the analytic report.

The data showed that in October 2021, with interest rates at an all-time low, borrowers would be paying a little more than £557 per month on a 2-year fixed-rate mortgage deal.

If the same homeowner were to remortgage now, they could expect to pay around £627 per month, which will equate to an extra £70 monthly, which is approximately an additional £840 per year.

In some instances, good mortgage deals are only made available to borrowers for a very short period of time, often just days, and are then removed from the market. What homeowners need to realise is that they can apply for a new mortgage up to six months prior to the end of their current mortgage arrangement.

L&C also stressed that offers from lenders are typically valid for 3 to 6 months, giving the borrowers “Rates are moving quickly, though, and deals rapidly come and go, often only lasting a matter of days before being replaced with higher rates. Sufficient time to make an application despite the fact that an ERC (early replacement charge) may stay in place for several months.

Associate director at L&C Mortgages, David Hollingworth, commented: “Mortgage rates have been shifting rapidly as lenders are forced to adapt to the impact of market expectations of higher rates on their funding costs.

“The sheer pace of change is something that could take borrowers by surprise, especially when the cost of living and other outgoings such as energy are already rising too.

“Fixed rates are still at historically attractive levels, so borrowers should review their current deal to make sure that they are on the best deal and protecting their position, especially against a backdrop of rocketing outgoings and further potential increases in the base rate.

“Borrowers can lock in at a current rate up to six months ahead, giving them the chance to review well ahead and ensure a smooth switchover when their current deal ends. That could help them get ahead of any further rate rises.”

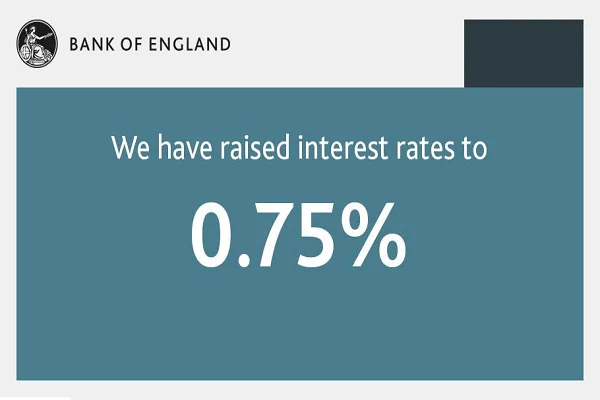

Base Rate Rise to 0.75% Expected from the Bank of England as Inflation Further Escalates

The Bank of England is under increasing pressure to raise interest rates as the Russian attack on Ukraine escalates. Despite the conflict bringing a high level of economic uncertainty to the UK and warnings from the Chancellor of a turbulent future, base rates are expected to rise to 0.75% this week. This, coupled with the expectation that base rates will go as high as 2% by the end of the year, is a real fear in UK households, with the cost of living going up every day.

In February this year, the Bank of England predicted that consumer price inflation would hit its highest level in April at 7.25%, coinciding with the expectation that gas and electricity bills would go up by a whopping 54% when the price cap increased.

These predictions have now been adjusted and are expected to rise to as much as a 9% inflation rate in the coming months. The rise in interest rates is an attempt by the Bank of England to fight the increasing cost of living, making borrowing far more expensive than previously.

With inflation currently at a 30-year high of 5.5% and expected to rise to more than four times the bank’s 2% target, it is imperative that the bank finds a way to get inflation under control.

The invasion of Ukraine by Russia has placed additional pressure on the Bank to increase the base rate.

The nine members of the Monetary Commission are predicted to increase the rate on Thursday of this week (17th March) from the current rate of 0.5% to 0.75% in the battle to gain control over the economy and inflation.

This indicates a third rise in the base rate since December 2021 and will mean increased mortgage costs for millions of UK homeowners.

The invasion of Ukraine has resulted in skyrocketing prices for natural gas, which have risen by an incredible 60% since February, prior to Putin’s troops entering Ukraine.

Experts have stated that the rise in interest rates will not have an immediate effect on inflation in the short term and that the escalating gas and electricity costs will be a struggle for every UK household but will ultimately reduce inflation. Achieving the right balance is the aim of the Bank of England.

Research director at the Resolution Foundation think tank, James Smith, stated, “I think it’s really tough for the bank at the moment to get this right. If they go too slowly, you get an inflation shock. If they go too fast, it chokes off recovery. And then there is a recession risk on top of that.”

The fear among experts is that increasing rates to keep prices down will have a detrimental effect on an already fragile economy. Sanctions levelled at Russia are resulting in massively increased oil prices, which are hitting each and every household with fuel prices going through the roof. All of this disruption is triggering fears of a potential recession.

Lenders Withdraw 500 Mortgage Products in a Single Month as Great Deals on Mortgages Become a Thing of the Past

More than 500 mortgage deals have been made unavailable by building societies and banks over the last month, with home buyers being left with no other choice than to take on mortgages with high-interest rates.

According to Moneyfacts, an institution that provides financial information services, when compared with data from the beginning of February, there were a whopping 518 fewer deals available at the beginning of March.

This indicates the biggest monthly drop in mortgage deal availability since May 2020, when, as a result of the COVID-19 pandemic and the economic uncertainty it brought, a massive 626 mortgage products were dropped.

The current number of mortgage products on the market for buyers to choose from is 4,838, which indicates a drop of 384 products from March 2020, when the pandemic first hit.

Lenders have removed these products as a direct response to the increased base rate set by the Bank of England. Some lenders have removed whole products from the market, while others have stopped lending for certain deposit sizes.

Further to this, the shelf life of some mortgage products has been reduced by 14 days over the last month, meaning potential home buyers have, on average, just 28 days to secure their preferred mortgage deal.

For five months in a row, both two-year and five-year fixed-rate mortgage interest rates have risen by 0.21% and 0.17%, respectively. The two-year fixed average rate, at 2.65%, is the highest seen since November 2015.

This is not good news for homeowners coming to the end of their two-year fixed-rate mortgage deal, who will find it extremely challenging to find another fixed deal at a decent interest rate, and they will find it virtually impossible to get a better one than they have previously enjoyed. This will become particularly relevant if the homeowner has little to no equity in their property, thereby making it difficult to access a higher LTV (loan-to-value) band and more competitive interest rates.

Five-year fixed-interest mortgage rates are showing their highest figures, at 2.88%, since April 2019. Homeowners approaching the end of their fixed rate deal may still have the opportunity to find a decent deal on a five-year fixed rate, as the average rate has stayed at 2.93%, which is 0.05% lower than what it was in March 2017.

The only mortgage products that showed signs of improved availability were 5% deposit loans, with seven new deals being added to the market. March 2022 was the first time that a 5% mortgage with a two-year fixed interest rate has shown an increase of 0.06% up to 3.11% since April 2021.

Even though the base rate set by the Bank of England has no direct effect on fixed interest rates, lenders typically increase their rates to cover any increased borrowing costs that will most definitely arise.

Last summer saw mortgage interest rates hit a historical low, with interest rate deals available at as little as 0.83%. This was largely due to lenders wanting to capitalise on a buoyant market and the fact that lending costs were at an all-time low, with the Bank of England lowering the base rate to 0.1%. This was subsequently increased to 02% in December, followed by another increase in February 2022, to 0.5%, with the expectation that further rises will be seen in the months to come.

Eleanor Williams, a finance expert at Moneyfacts, said: ‘Borrowers contemplating securing a new mortgage deal may be disheartened to see that rates are continuing to rise this month.

‘While factors beyond lenders’ control are uncertain, as the cost of living crisis continues and economic conditions are volatile, to mitigate the risk of default, it could be that providers may tighten their lending belts even further moving forward.

‘Borrowers looking to get onto the property ladder or to remortgage may therefore be wise to seek advice to ensure they are abreast of the changing market and to move forward with securing the most suitable deal for them.’

Finding a good fixed-interest deal

There are still many decent fixed-term deals out there that are significantly lower than the average figures provided by Moneyfacts, particularly for clients with large deposits and/or equity in their property. Experts warn buyers to consider their options carefully and shop around to find the best deal before committing to any fixed-rate mortgage product.

“Rates have gone up, which will cost homebuyers a little bit more, but I want to stress that this shouldn’t put people off moving to the house of their dreams or taking that first step to get on the property ladder.

‘We’ve seen a sharp and slightly panicky reaction to the Bank of England base rate rising to 0.5 per cent in February, but 30 years ago, in 1992, it was more than 20 times higher at 10.38 per cent. So, we must view this rise with some much-needed context and with a cool head.’

Even though mortgage interest rates are still relatively low when compared with historical figures, the average house price is increasing but not in line with the average income.

Average UK House Prices Hit New All-Time High in February

Economic uncertainty has become the norm as the UK continues to deal with the lingering after-effects of COVID-19. But while some sectors are struggling to get back to pre-pandemic performance levels, others are breaking records left, right, and centre.

Once again, average house prices hit a new all-time high in February, exceeding £260,000 for the first time. Data published by Nationwide suggests an astonishing 12.6% average annual growth rate for the month, taking house prices in most key UK regions to new record highs.

This is the largest year-on-year increase since Nationwide’s monthly index was launched in 1991, suggesting staggering performance for the sector despite the highest level of inflation in over three decades.

On average, the price of a UK home is now approximately £44,000 higher than it was before the pandemic hit, an increase of around 20%.

Supply continues to lag behind demand

According to Nationwide, issues with available inventory are the main cause of the past year’s record of property price increases. Demand continues to exceed supply in most areas of the UK, with affordable inventory having all but dried up entirely.

Meanwhile, house price growth continues to outpace wage rises, making it increasingly difficult for the average UK worker to buy their own home.

“The continued buoyancy of the housing market is of little surprise, given the mounting pressure on household budgets from rising inflation, which reached a 30-year high of 5.5% in January, and since borrowing costs have started to move up from all-time lows in recent months,” commented Nationwide.

“The squeeze on household incomes is set to intensify, with inflation expected to rise above 7% in the coming months,”

“Indeed, there is scope for inflation to rise even further as events in Ukraine threaten to send global energy prices even higher.”

“Assuming that labour market conditions remain strong, the Bank of England is also likely to raise interest rates, which will exert a further drag on the market if this feeds through to mortgage rates for customers.”

A positive picture for current homeowners

While the housing market is becoming increasingly inaccessible for first-time buyers, all-time record house prices are benefiting millions of existing homeowners.

“This performance really is quite alarming when you consider the wider economic turmoil that we’ve faced for some years now, and it proves that there really is no safer investment than bricks and mortar.”

“Even across London, where market conditions have remained far more muted, values have continued to climb, and the capital’s property market is now poised to enjoy an accelerated rate of growth over the coming year.”

Further monthly property price increases have been forecast by all major banks and lenders, though at a significantly slower rate than those recorded over the past year.