UK’s most competitive rates for development finance from 0.7%

Here at UK Property Finance Ltd, we are a “Whole of Market” broker with access to the best rates available, enabling us to deliver affordable financing for all types of property purchases and development.

- 90% LTV and/or 75% loan of total GDV

- Loan amounts range from £25,000 to £100,000,000

- Finance for new builds and conversions

- Multi-unit and single-unit development projects

- Multi-use property development

- Commercial development projects

- Finance for both experienced and first-time developers and investors

- Options for development finance, including regulated and unregulated

- Funding for the acquisition and development of partially completed projects

- 100% of the build cost and 70% of the land cost from day one of the project are available

- Joint venture opportunities

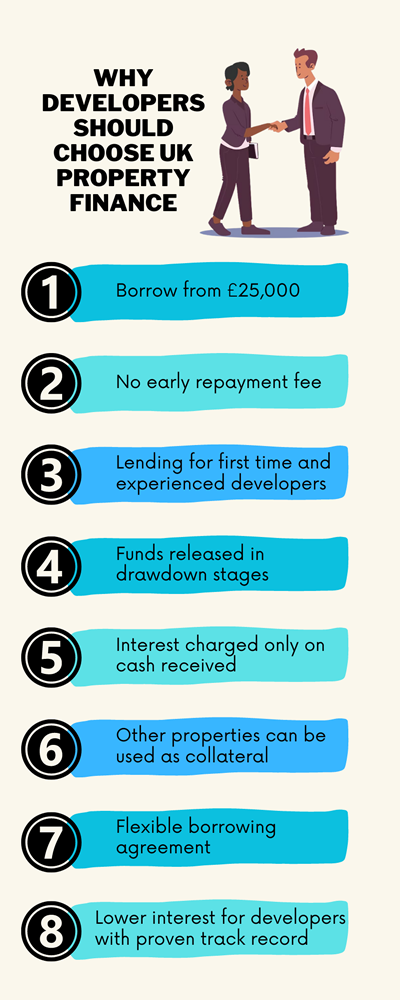

Key features of development finance

- Loans available from £25,000 upwards

- There are no early repayment fees for the majority of the development loans we offer; however, there may still be exit fees

- First-time developers and experienced developers are welcome to apply

- Funds are released in stages in accordance with project requirements, and interest is charged only on cash received

- Secured loans are available where other properties can be used as collateral

- Flexible terms to meet your individual project needs: If your project comes in under budget, you will not be required to borrow the full agreed-upon amount

- Competitive and low-interest rates for developers with a proven record of success

Criteria for development finance

As a general rule of thumb, the following lending criteria will be required:

- Loans starting from £25,000 with no upper limit

- Loan terms of up to 24 months

- Interest rates range from around 7% pa

- Interest is ‘rolled up’ and paid at the end of the loan period; therefore, there are no monthly interest charges

- Average lender arrangement fees of 1-2% of the entire loan amount

- In some instances, exit fees will be charged, usually when the LTV is high

- Land purchase LTV of 75% and build cost of 100%

- Drawdowns will be made in line with cash flow requirements, subject to careful monitoring by the lender using a QS/monitoring surveyor

- Valuations performed by the lender both before development and after to assess the value of the completed project (GDV) and the initial build costs

Advantages of development finance

The most beneficial aspect of development finance is that it gives developers and investors access to large amounts of money in order to finance big development projects.

The total amount needed is carefully assessed, with funds being released at key stages of the development. The entire cost of the build can be borrowed with no specific upper limits, giving the developer the flexibility to bring the project to a successful completion.

Advantages include:

- Development loans can be secured against buildings, land, and developments considered unsuitable by other lenders, including derelict and run-down properties.

- Because development finance can be repaid in a short period of time, overall borrowing costs can be kept to a minimum.

- Funds are released in stages, according to the progress of the project, and interest is only charged on money the borrower has actually received; therefore, there is the opportunity to keep costs down.

- There are no real limitations on the amount that can be borrowed, provided that sufficient proof that the development will be successfully completed is provided to the lender. 100% of the total construction cost can be borrowed.

Costs and fees associated with development finance

There are various fees you will need to take into account when calculating the total cost of your development project:

Facility Fee: Also commonly referred to as the arrangement fee. This fee is typically calculated as a percentage of the total loan amount.

Interest Rate: Interest on development finance can be paid on a monthly or yearly basis. Yearly rates are typically around 7%, and monthly rates are around 1%.

Exit Fee: Also referred to as a completion fee, which is calculated as a percentage of the total loan cost, lenders may calculate the exit fee as a percentage of the value of the completed project as opposed to the loan value.

Broker Fee: The industry standard is around 2% of the net loan.

Valuation Fees: As development finance is a secured type of loan, it will require that a full valuation of the assets offered for security be valued by a neutral third party. The completed project will typically be valued at the same time.

Application Fee: Some lenders will impose a fee simply for making an application or may charge a commitment fee.

Legal Fees: Any required legal advice or the need for a solicitor for any reason will result in legal fees that will have to be paid by the borrower.

Administration Fees: These fees can refer to just about any administrative work and are therefore somewhat vague in terms of what they include. UK Property Finance does not charge any administration fees.

Monitoring Fees: Due to the monitoring required by the lender on each development to ensure that the project is reaching its predetermined goals, you will need to pay monitoring fees. This is to ensure that the funds being released are allocated as agreed and that the lender’s investment is safe.

Drawdown Fees: This is a fee that is sometimes imposed every time funds are released to the developer. The fee can be a fixed amount or a percentage of the project.

Telegraph Transfer Fee: Also referred to as TT fees, this is the fee charged by the banks handling the transfer of funds, which in the case of a development loan will involve large sums of money. TT fees tend to be low and are typically fixed.

Development finance: the process

Development loans are typically tailored to meet the individual developer’s requirements according to the specifics of the project. When applying for development finance, there are several key stages that you can expect.

- Initial enquiry and a non-obligation, free consultation

- Comparison of deals from specialist lenders offering property development finance in the UK

- Submission of the initial application to suitable lenders

- Agreement in Principle issued by the lender to the borrower

- Visit the site to establish the viability of the development project

- Independent valuation of the project’s total value

- Formal offer and terms of loan issued

- Solicitor involvement for legal advice and support

- Completion of the loan and the first payment released (drawdown)

- Periodic instalments to fund each stage of the development

- Repayment of the loan as agreed at the end of the loan term

The above should be taken into consideration.

What is developer finance?

Developer finance is a sort of capital that is especially designed to assist property developers in the acquisition, planning, and construction of real estate projects. It is also sometimes referred to as property developer finance or development finance. Developers can utilise this type of finance to fund projects ranging from residential dwellings to commercial and mixed-use complexes. It is specifically tailored to address the particular requirements and difficulties linked with property development.

Can you get 100% development finance?

Obtaining 100% development finance is a rare and difficult situation in which a lender pays the whole cost of a development project without requiring the borrower to provide any equity. The majority of lenders, including those who provide development finance, usually demand that developers provide equity in the form of a predetermined portion of the project’s cost. By aligning their interests with the development’s performance, the developer’s participation in the project is represented by this equity contribution.

What does a development finance specialist do?

An expert in offering financial advice and knowledge exclusively for real estate development projects is known as a development finance specialist. These experts are essential in assisting developers in obtaining capital, resolving financial difficulties, and maximising the financial aspects of development projects.

Who is eligible for development finance?

Lenders usually evaluate a borrower’s eligibility for funding based on a number of characteristics, including their eligibility for development finance. While lenders may have different specific eligibility requirements.

Is development finance regulated?

The rules controlling lending activities in a given area and the financial regulatory framework can have an impact on how development finance is regulated, and this can differ from jurisdiction to jurisdiction. Lending and other financial services are governed by regulations in many nations in order to protect consumers, maintain financial stability, and comply with legal and ethical requirements. The kind of financial institution providing development finance as well as the type of loan activity may determine the degree of regulation.

How long does it take to get development finance?

A number of variables, such as the project’s complexity, the lender’s procedures, and the borrower’s effectiveness in supplying the necessary paperwork, might affect how long it takes to secure development financing.

How is development finance repaid?

Interest is added on a monthly basis, so the sooner you repay the loan, the less interest there is, which reduces the overall cost. In most instances, the loan is settled in full through refinancing or the sale of the property.

- Build to sell: the developer intends to sell, in full or in part, in order to repay the property development loan.

- Build to rent: the developer intends to rent out the property and will find long-term finance, for example, a mortgage, to repay the development loan.

- A combination of the two: the developer intends to sell part of the development upon completion and retain the apportion to be rented out.

What is a development term loan?

A development term loan is a type of financing specifically designed to fund property development projects, such as construction or renovation. Unlike traditional mortgages, which are typically used to purchase existing properties, development term loans provide funds to cover the costs associated with developing a property from the ground up or refurbishing an existing property. These loans often have flexible repayment terms tailored to the specific timeline of the development project, with funds typically disbursed in stages as different milestones are reached. Development term loans are secured against the property being developed, providing assurance to the lender and potentially allowing for more favorable terms compared to unsecured financing options.

How to get a loan for a development project?

To secure a loan for a development project, several steps are typically involved. Firstly, thoroughly research lenders who specialise in development financing and assess their loan products to find one that suits your project’s needs. Prepare a detailed business plan outlining the scope of the development, projected costs, timelines, and potential returns on investment. Next, gather all necessary documentation, including architectural plans, permits, and financial statements, to demonstrate the viability of the project to potential lenders. Approach lenders with your proposal, providing comprehensive information and answering any questions they may have. Be prepared for a thorough evaluation process, which may include appraisals, credit checks, and assessments of your experience and track record in property development. Once approved, ensure you adhere to the loan’s terms and use the funds responsibly throughout the development process.

Development exit finance

Development exit finance can be used by developers to repay debts prior to selling the development after its completion. The benefits of developer exit finance include:

- Cutting costs and increasing profit due to exit finance being typically cheaper at this stage

- Bridging the gap between the completion of the project and the sale if the current loan term reaches its conclusion before the sale is completed.

- Freeing up capital at an earlier date enables developers to commence new development projects before the completion of the sale.

Development exit finance is a type of bridging loan that can be arranged quickly, is short-term, and has relatively low-interest rates, making it an attractive option for developers.

Example of development finance

A development loan is a short-term lending facility used for the purchase of land and/or property intended for development. The funds are released in stages or drawdown payments upon completion of pre-agreed work. At each drawdown, a surveyor (usually the surveyor who made the initial valuation) will visit the site and authorise the release of further funds. This is to ensure that all pre-arranged work stages are being met and that the funds are being used appropriately.

Case Study – a developer in Bradford

The developer had purchased a derelict mill situated in the centre of Bradford, near the university, and had gained planning permission to develop 62 student pods. The developer had already spent substantial funds to start the development and now needed £600,000 extra to complete the required work. Importantly, they had a tough deadline and were trying to complete the building in time for the students returning for the start of the next academic year.

UK Property Finance quickly secured the £600,000 needed over a 12-month term. Building work was able to continue unhindered, and after only 6 months, the project was completed and the bulk of the pods were rented. The monthly interest was rolled throughout the term of the loan, meaning the client was not required to make any monthly payments, but instead, the interest was paid at the same time that the loan was repaid.

Interest on the development loan was calculated for the time that the money was outstanding, i.e., 6 months, not the full 12-month term, and we ensured from the beginning that the chosen scheme had no penalties for early repayment.

Typical project costing breakdown

| Site cost/valuation: | £800,000 |

| Build cost (released in stages): | £600,000 |

| End valuation: | £2.4million |

| Developer profit: | £1 million |

Since the property was mainly let on standard assured short-hold tenancy agreements after 6 months, UK Property Finance was able to arrange Long Term Commercial Finance to repay the development loan via a high street funder.

Our swift and proactive approach enabled our client to maximise profitability by ensuring the funding was available in time to complete the build, thus enabling students returning to university to habit the pods.