Bridging Loan Calculator

Our bridging loan calculator gives a good indication of the expected rates and repayment costs when applying for a bridging loan. Get the best bridging loan rates in the UK, starting from 0.55%. All our bridging finance quotes are fully FCA-regulated (667602).

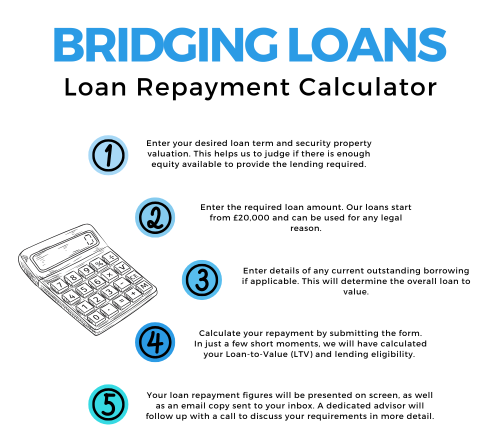

How to use our calculator

The bridging loan calculator we provide can help you determine how much you can borrow and what your monthly repayments would be.

Here’s how to use the calculator:

- Input the property value: Enter the value of the property you are selling.

- Input the loan amount: Enter the amount of money you need to borrow.

- Input the loan term: Enter the length of time you need the loan for (in months).

- Input the interest rate: Enter the interest rate you have been offered (or use the calculator’s default rate).

- Click on the ‘Calculate‘ button.

The calculator will then show you the following information:

- The maximum amount you can borrow: This is based on the loan-to-value (LTV) ratio, which is the percentage of the property value that the lender is willing to lend you.

- The monthly interest payment: This is the amount of interest you will pay each month on the loan.

- The total cost of the loan: This is the total amount of interest you will pay over the life of the loan.

Low Bridging Loan Rates 0.55%

The table below provides examples of what the bridging loan repayments would be on an example loan amount of £100,000, which is a popular amount for bridging finance. Alternatively, use the bridging loan calculator above for a rough calculation of your loan. For an accurate quote with a breakdown of costs, please speak to one of our experienced advisors; they can inform you of the rate of interest and any other questions you may have.

| Interest Rate | Monthly Interest |

|---|---|

| 0.55% | £550 |

| 0.70% | £700 |

| 0.75% | £750 |

| 0.85% | £850 |

| 0.95% | £950 |

| 1.00% | £1,000 |

| 1.05% | £1,050 |

| 1.10% | £1,100 |

| 1.20% | £1,200 |

| 1.25% | £1,250 |

| 1.50% | £1,500 |

Who is eligible for a bridging loan?

Each lender will have its own set of bridging financing standards that a borrower must meet in order to be approved for a loan. However, most borrowers fall into the following categories:

Please keep in mind that while collateral is required, credit history is frequently irrelevant, and proof of income is unnecessary.

· A private person, partnership, or limited corporation.

· Buying or renovating residential or commercial property.

· Over the age of 18: Some lenders have an upper age limit.

· Live or have a registered address in the United Kingdom.

· Has some type of security – often one or more properties against which the loan can be secured.

· Has a clear exit strategy in place, such as selling the property, refinancing, or receiving funds.

· Wants to borrow at least £10,000.

· Employed, self-employed, or retired.

A survey based on the reasons for why a bridging loan was taken out showed the following:

| Reason for needing a bridging loan | % Ratio |

| Main residence property | 24.58% |

| Semi-commercial or mixed use | 19.24% |

| Light non structural refurb | 11.47% |

| Commercial property | 7.08% |

| Land with planning | 6.55% |

| Property development | 5.28% |

| Residential investment | 4.15% |

| Heavy refurb or structural work | 4.01% |

| Company Tax or VAT bills | 3.32% |

| Avoid residential foreclosure | 3.17% |

| Avoid investment foreclosure | 2.87% |

| Self Assessment or Capital Gains tax | 2.41% |

| Rebridge facility | 2.24% |

| Land without planning | 2.15% |

| Other | 1.48% |

(Based on 2023 available market data)

Securing a Bridging Loan

Taking out bridging finance in the UK involves several steps to secure short-term funding for a property transaction. This type of loan product is typically used to cover the gap between the sale of a current property and the purchase of a new one. Below are the steps and processes to be aware of during the loan procurement process:

- Do your research: Identify a suitable broker that deals with bridging finance. A good place to find a broker with a credible reputation is by using Trustpilot.

- Application: Contact your chosen broker and begin the application process. They will most likely request details from you on the size of the loan needed, the value of the property in question, what the purpose of the funds will be, and the intended method of repaying the loan. Other information may also be requested as the process continues. Contact the team if you have any questions at any time.

- Loan Offer: Once the lender reviews your application and property value, they will issue a formal loan offer. This offer will outline the terms and conditions of the bridging finance, including the interest rate, repayment schedule, fees, and any specific requirements.

- Legal and Due Diligence: Engage with solicitors or legal professionals to review the loan agreement and ensure it aligns with your needs and expectations. Due diligence is conducted to verify your identity, ownership of the property, and any legal issues related to the property prior to the bridging loan being approved.

- Acceptance and Documentation: If you are satisfied with the loan offer and the legal aspects, you’ll formally accept the offer. This usually involves signing the loan agreement and providing any necessary documentation requested by the lender.

- Exit Strategy Confirmation: Bridging loans are short-term, so you’ll need to have a clear exit strategy in place to repay the loan. This could be through the sale of the property, securing a long-term mortgage, or any other planned source of funds. The lender will want to ensure you have a viable plan in place.

- Funds released: Once all documentation is in order and the lender is satisfied with the due diligence, they will disburse the funds. The funds can be used to complete property purchases, renovations, or any other planned purpose.

- Repayment: A bridging product works differently from a conventional loan product, with interest deferred until the completion of the loan term rather than a monthly payment amount. Repayment of the principal loan amount usually occurs when your exit strategy is executed.

- Exit Strategy Execution: When your exit strategy is ready to be executed, such as the sale of the property or securing a longer-term mortgage, you’ll use the funds from the exit strategy to repay your bridging loan in full.

- Loan Closure: Once your bridging finance is fully repaid, the lender will provide a statement confirming the closure of the loan account. Any legal charges or security arrangements will be released.

Should I deal directly with a bridging loan lender or a broker?

Deciding between a lender and a broker depends on your comfort level and needs. Brokers offer wider lender options, expertise in navigating the application process, and potentially better deals, but charge fees. Direct lenders can be faster and cheaper, but they require more legwork and may not offer the most competitive rates.

Administrative fee

If the loan is taken out, the lender will levy an administrative fee of around £295. This is not an application fee; it is payable only if you take out the loan.

Valuation fees:

These costs vary depending on the value of the property(s) being used as security. Their location and the type of report requested are also important considerations. Our calculator offers an estimate for the cost of a thorough valuation. Desk-top appraisals are less expensive and faster to do; therefore, we employ them wherever possible. Valuation fees are necessary for valuations and must be paid directly to the surveyor or lender.

Redemption charge:

Lenders impose a redemption fee when a loan is redeemed. This is the legal expense of removing the charge from the secured property.

Solicitor fees:

The lender hires a solicitor to handle the loan contracts and places a charge on the security property. The charges associated with this are charged to the applicant. Our calculator provides an idea of the amount paid for lenders’ legal expenses.

Broker and exit fees:

We do not charge broker fees, and none of our loan programmes include exit costs.

The amount you can borrow will be based on the LTV, and the bridging loan interest rates will vary depending on the lender.

UK Property Finance Ltd. is a whole of market broker, and as such, we can guarantee the best rates and bridging loan deals on the market for our clients.

Give us a call; we will be happy to have a no-obligation chat about how our bridging finance can benefit you.